Help Pay for College with an Individual Development Account (IDA)

Have you heard of Individual Development Accounts? An individual development account (IDA) is a savings account that helps low- and moderate-income individuals save money for education, job training, or first-time homeownership. IDAs are typically matched by public or private funds, which can help individuals reach their savings goals faster.

For adult students who are looking to go back to school, IDAs can be a great option. They can help students save money for tuition, fees, books, and other expenses. IDAs can also provide financial education, which can help students learn how to manage their money and make sound financial decisions.

Here are some of the benefits of an IDA for adult students:

- Match funds: IDAs can be matched by public or private funds, which can help students reach their savings goals faster. The match rate varies depending on the IDA program, but it can be as high as 3:1. For example, if a student saves $100, they could receive a match of $300, for a total of $400.

- Financial education: IDA participants typically receive financial education, which can help them learn how to save money, manage their finances, and make sound financial decisions. This education can be invaluable for adult students who may not have a lot of experience with financial matters.

- Asset building: IDAs can help low-income individuals build assets, which can lead to financial stability and self-sufficiency. Having a savings account can help students feel more secure financially and can give them a sense of accomplishment.

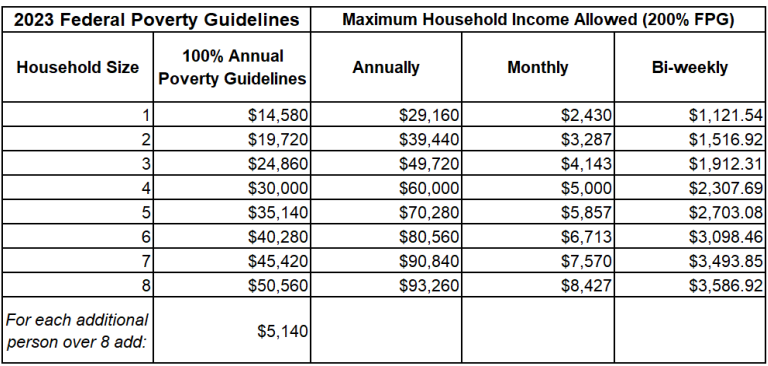

To qualify for an IDA, individuals must meet certain income and asset requirements. The requirements vary depending on the IDA program, but they typically include being low-income and having a limited amount of savings. The 2023 guidelines are as follows, this program allows for families to be at or below 200% of federal poverty guidelines. For example, a family of five could qualify if their annual household income is less than $70,280.

If you are an adult student who is interested in opening an IDA, check out our direct links to both Indiana and Michigan program administrator pages.

Indiana

Michigan

- Michigan IDA Information

- Michigan IDA Partnerships (per region)

If you live in a different state, simply search the internet for IDAs in your state.

Here are some additional tips for adult students who are considering opening an IDA:

- Start saving early. The sooner you start saving, the more time your money has to grow.

- Set realistic goals. Don’t try to save too much money too quickly. Start with a small goal, such as saving $100 per month, and gradually increase your savings as you get closer to your target.

- Take advantage of match funds. If your IDA program offers match funds, make sure to contribute as much money as you can to maximize your match.

- Get financial education. IDA programs typically offer financial education. Take advantage of this opportunity to learn how to manage your money and make sound financial decisions.

With careful planning and effort, an IDA can help you achieve your educational goals and build a brighter future for yourself.

Enrolling in an IDA program is not a quick process, so even if you have the faintest thoughts about attending college, investigate IDAs right away as planning ahead can save you both time and money!

If you found this information helpful, maybe Bethel might be the right place for you! Request information from our team today to see how Bethel can help you use your gifts for leadership in the church and in the world!